4.5 LPA In Hand Salary – How Much Will You Take Home

India’s job market is diverse, with salary expectations varying widely across sectors and regions. Understanding salary structures is crucial for employers and job seekers to ensure fair and competitive compensation.

In general, salaries in India are expressed in annual packages, often discussed in terms of “Lakhs Per Annum” (LPA), which reflects the growing economy and evolving job market. Urban centres like Mumbai, Bangalore, and Delhi typically offer higher salaries than other parts of the country due to the concentration of tech companies and multinational corporations.

An annual salary of 4.5 LPA in India typically translates to a monthly in-hand salary between ₹32,000 to ₹34,000, after accounting for deductions like EPF and taxes. This estimate can vary based on specific deductions and allowances set by the employer.

LPA is “Lakhs Per Annum,” a common term used in India to denote an individual’s yearly earnings. One lakh equals one hundred thousand rupees. This metric is pivotal for job seekers as it provides a clear picture of total earnings before deductions like taxes or provident fund contributions are made.

Understanding the LPA is essential for comparing job offers, negotiating salaries, and planning financial goals. It helps assess a position’s market value and understand how components like basic pay, bonuses, and allowances add up to total compensation.

By grasping the concept of LPA, job seekers can better navigate their career choices and financial planning, making it a fundamental aspect of India’s employment search and decision-making process.

Understanding 4.5 LPA:

In India, a salary of 4.5 LPA (Lakhs Per Annum) means an annual income of 450,000 rupees. This figure represents the gross yearly earnings before deductions such as taxes, provident fund contributions, or other benefits are subtracted to determine the take-home or in-hand salary. This salary level is often considered a middle-range income in many parts of India, suitable for entry to mid-level professionals in various fields.

Compared to other standard salary benchmarks in India, 4.5 LPA is above the minimum wage across all states but below the compensation packages typically offered for senior roles in larger cities or high-demand sectors like technology and finance. For example, entry-level IT professionals or engineers in metro cities may start with salaries ranging from 3 to 6 LPA, while experienced professionals can earn significantly higher. In contrast, roles in education or administrative positions in smaller cities might align closer to the 4.5 LPA mark, illustrating the wide variability depending on industry, location, and job role. This benchmark helps job seekers gauge where they stand in the job market and assists employers in structuring competitive salary packages.

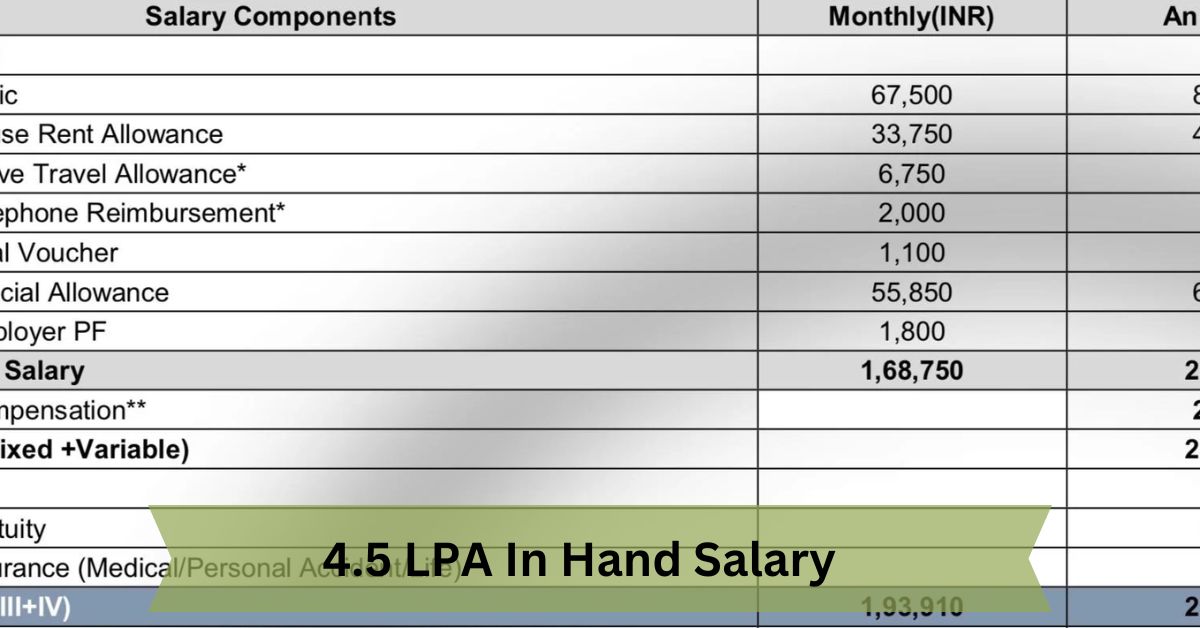

Components Of The Salary Package:

Basic Salary:

The essential salary component of a salary package is the core income portion before any extras are added or deductions are made. It is usually a fixed part of the compensation structure and forms a large percentage of the total pay, typically ranging from 40% to 50% of the gross salary.

House Rent Allowance (HRA):

This is a specific allowance provided to employees to cover housing expenses. The amount of HRA received depends on the salary and the city of residence, with higher allowances generally given in metro cities. HRA can also provide tax benefits, with portions of the allowance being exempt from taxes under certain conditions.

Special Allowances:

These include various types of earnings tailored to the employee’s specific needs or requirements or the nature of the job. Examples include travel allowances, education allowances, medical allowances, or performance-linked bonuses that vary from one organization to another.

Read More: Ted Parker Obituary Lumberton Nc – kindness with us!

Explanation Of Other Common Inclusions: Bonuses, Medical Insurance, And Transport Allowances:

Bonuses:

Often linked to performance, company profit, or festive seasons, bonuses are paid over and above the basic salary. They can be fixed or variable and are typically specified in the employment contract.

Medical Insurance:

Many companies offer medical insurance as part of their salary package. This benefit covers various health-related expenses for employees and sometimes their families, which can be a significant financial relief, especially during emergencies.

Transport Allowances:

Transport allowances are provided to assist with daily commuting costs. This fixed amount is intended to cover expenses related to travel from home to work and back. Like HRA, this allowance can also offer tax advantages under certain conditions.

Calculating In-Hand Salary From 4.5 LPA:

Explanation Of Gross Vs. Net Salary:

- Gross Salary is the total amount an employee earns before any deductions are made. It includes the basic salary, house rent allowance (HRA), special allowances, and other benefits or bonuses. In the case of a 4.5 LPA salary, the gross annual salary is ₹450,000.

- Net Salary, often called in-hand salary, is the amount an employee takes home after all deductions are applied to the gross salary. These deductions can include taxes, provident fund contributions, and other statutory costs.

Standard Deductions: EPF, Professional Tax, And Income Tax:

- Employee Provident Fund (EPF): Typically, 12% of the basic salary is deducted for EPF, a retirement benefits scheme for salaried employees. Employers match this contribution by donating 12% towards EPF, although only 3.67% goes into the EPF account, with the rest directed to the Employee Pension Scheme (EPS).

- Professional Tax: This tax is levied by the state governments in India on employed individuals. The amount varies from state to state but is generally a small deduction from the monthly salary.

- Income Tax: Based on the current tax slabs in India, if a person’s annual income is ₹450,000 (4.5 LPA), they would fall into the tax bracket where the taxable amount is subjected to income tax. With standard deductions and exemptions, the actual tax payable could vary.

Examples Of How To Calculate In-Hand Salary From A 4.5 Lpa Gross Salary:

Let’s calculate an approximate in-hand salary assuming the individual has no other income or deductions except for standard EPF and tax:

- Annual Gross Salary: ₹450,000

- Annual EPF Contribution (Employee): 12% of the basic salary (assuming the basic is 50% of gross, i.e., ₹225,000) = ₹27,000

- Professional Tax: Assuming ₹200 per month = ₹2,400 per year

- Income Tax: For simplicity, assuming a tax deduction of ₹10,000 after considering standard deductions and exemptions

- Total Annual Deductions: EPF + Professional Tax + Income Tax = ₹27,000 + ₹2,400 + ₹10,000 = ₹39,400

- Annual Net Salary: Gross Salary – Total Deductions = ₹450,000 – ₹39,400 = ₹410,600

- Monthly In-Hand Salary: ₹410,600 / 12 ≈ ₹34,217

This is a simplified example. Actual calculations may vary based on specific allowances, exemptions, and other financial engagements of the individual. Employing an online salary calculator or consulting with a payroll expert can provide more accurate figures tailored to individual circumstances.

Factors Influencing In-Hand Salary:

Role Of Tax Slabs And Exemptions Under The Income Tax Act:

In-hand salary is directly affected by income tax slabs, which determine how much tax an employee pays based on their annual income. Various exemptions and deductions, like investments (Section 80C) and medical insurance (Section 80D), can further reduce taxable income. These not only reduce tax but also increase the net salary received.

Impact Of Employee Benefits Like Health Insurance And Retirement Plans On Take-Home Pay:

Benefits such as health insurance and retirement plans also affect in-hand salary. For instance, contributions to a provident fund decrease gross income but help build tax-free retirement savings. Similarly, employer-provided health insurance can be a nontaxable benefit, effectively increasing take-home pay while offering financial security. These benefits often balance between immediate cash in hand and long-term economic health.

Tips For Negotiating Salary:

Understanding In-Hand Salary For Effective Negotiations:

Knowing your in-hand salary helps you set realistic expectations during salary negotiations. When you understand the deductions that impact your gross salary, you can better evaluate job offers and negotiate terms that maximize your take-home pay. This awareness can lead to more informed discussions about your net salary expectations with potential employers.

The Significance Of Total Compensation:

During negotiations, it’s crucial to consider the entire compensation package, not just the gross salary. This includes bonuses, health benefits, retirement plans, and other perks that can enhance your total earnings. By valuing these components, you can negotiate a package that offers long-term benefits beyond the monthly paycheck.

Leveraging Benefits In Negotiations:

Understanding how benefits like medical insurance, retirement contributions, and other perks affect your overall compensation allows you to negotiate more effectively. For instance, if an employer offers significant contributions to a retirement plan, you might accept a slightly lower salary due to the long-term value of those contributions.

Looking Beyond The Numbers:

While the salary figure is essential, consider other factors such as job role, career growth opportunities, work-life balance, and company culture. Sometimes, these aspects are worth accepting a lower salary if they align better with your long-term career and personal goals. This holistic approach to salary negotiations can increase job satisfaction and success in your role.

Conclusion:

Understanding the intricacies of salary components like 4.5 LPA and the factors influencing in-hand salary is crucial for job seekers and employers. This knowledge aids in effective salary negotiations, ensuring that all parties clearly understand the total compensation package beyond just the gross salary. By appreciating the significance of additional benefits and the impact of taxes and other deductions, individuals can make informed decisions that align with their financial and career goals. A well-negotiated salary package that considers all these aspects can increase job satisfaction and economic stability.

FAQ’s:

How Does The Cost Of Living Impact My In-Hand Salary From A 4.5 Lpa Package?

The cost of living in your location affects the actual value of your in-hand salary. The exact wage might offer lower purchasing power in cities with higher living costs than in towns with lower fees.

Can Negotiating Non-Salary Benefits Improve My Overall Compensation Package?

Yes, negotiating non-salary benefits such as flexible working hours, remote work options, or additional vacation time can enhance your overall compensation package and work-life balance, even if the in-hand salary remains the same.

How Often Should I Reevaluate My Salary Package?

It’s wise to reevaluate your salary package annually or whenever there is a significant change in your job role, responsibilities, or the economic environment to ensure your compensation remains competitive and fair.

Read More: