Is Beagle Legit – A Simple Guide!

Beagle is a service designed to help people find and manage their old 401(k) accounts. Many people wonder, Is Beagle legit?

Yes, Beagle is a legitimate service. It helps people find and manage their old retirement accounts. Users generally report positive experiences with it.

So, we’ll explore how Beagle works, its benefits, potential drawbacks, and overall trustworthiness.

What is Beagle? – An Overview!

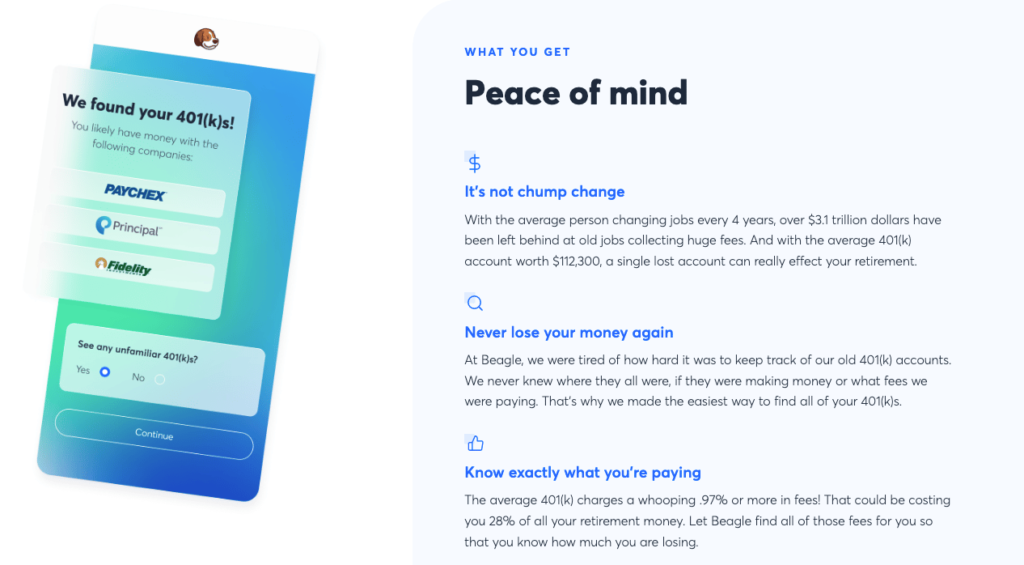

Beagle is a financial service that helps you find old 401(k) accounts from previous jobs. When people change jobs, they often forget about their retirement savings left with past employers. Beagle searches for these lost accounts so you can keep track of all your retirement money.

So, it makes it easier to manage your savings and plan for the future. By using Beagle, you can make sure you don’t miss out on any of your hard-earned retirement funds. It’s a handy tool for anyone who has worked at multiple companies over the years.

How Does Beagle Work? – Step-By-Step Guide!

- Sign Up: You start by signing up on Beagle’s website. You will need to provide some basic information like your name, Social Security number, and details about your former employers.

- Search for Accounts: Beagle uses this information to search for any old 401(k) accounts you might have. This can include accounts from jobs you had many years ago.

- Analyze Fees: Once Beagle finds your accounts, it looks for any hidden fees. Over time, these fees can gradually diminish your retirement savings.

- Roll Over Accounts: If you want, Beagle can help you roll over these old accounts into a new one. This can significantly simplify the management of your retirement savings.

Also read: Snapchat Planets In Order – Explore Your Snap Universe!

Benefits Of Using Beagle – Exploring Each!

Find Lost Accounts:

Beagle can help you find old 401(k) accounts that you might have forgotten about. This ensures that all your retirement savings are accounted for. By consolidating these accounts, you can have a clearer picture of your total retirement savings. This can assist you in making more informed financial choices.

Reduce Fees:

Beagle helps you identify and reduce hidden fees. This means more of your money goes towards your retirement rather than to fees. Many people are unaware of the fees that eat into their savings, and Beagle brings these to light. By minimizing these costs, you can grow your retirement fund more efficiently.

Simplify Management:

By rolling over your old accounts into a new one, Beagle makes it easier to manage your retirement savings. Juggling multiple accounts can be perplexing and time-intensive. Beagle simplifies this by consolidating your accounts into one, making it easier to track your progress and adjust your investments as needed.

Borrow from 401(k):

Beagle allows you to borrow money from your 401(k) at 0% net interest. This can be a useful feature if you need access to cash. Borrowing from your 401(k) can be a better option than high-interest loans. Hence, it provides a flexible way to access funds while still keeping your retirement savings on track.

What Are The Drawbacks Of Using Beagle? – Need To Know!

While Beagle offers many benefits, there are also some drawbacks to consider. One issue is that the service may charge fees for its account recovery and management features. These fees can reduce the overall savings you gain from using Beagle.

Is Beagle legit? Yes, but some users might find the process of rolling over accounts to be complex or time-consuming. Is Beagle legit? Indeed, there’s also a risk that Beagle might not find all lost accounts, especially if they are very old or not properly documented.

Furthermore, borrowing from your 401(k), even at 0% net interest, can impact your long-term retirement savings if not managed carefully. Lastly, is Beagle legit? Yes, however, relying on an external service means trusting them with sensitive financial information, which can be a concern for some users.

Also read: Freeopenerportable_2.0.1.0 – Your Ultimate Guide!

Is Beagle Legit? – Safety Comes First!

When asking, Is Beagle legit? safety is a major concern. Beagle is a registered investment advisor with the SEC (Securities and Exchange Commission).

This means it follows strict regulations to ensure your money is safe. Additionally, all securities are insured up to $500,000, providing an extra layer of protection for your investments.

So, Is Beagle Legit Yes. Beagle uses encryption to protect your personal and financial information, ensuring it stays private. They also have customer support to help with any issues or questions you might have. Beagle’s platform is designed to be user-friendly, making it easy to manage your accounts.

Reviews from users generally highlight positive experiences and reliable service. This shows that Beagle is committed to maintaining trust and transparency with its users.

Customer Reviews About Beagle – Check It Out!

Customer reviews can give us more insight into whether Is Beagle legit. Overall, Beagle has positive reviews from its users. People appreciate how easy it is to find old 401(k) accounts and reduce fees.

However, some users mention that the upfront fees can be a bit high. It’s always a good idea to read several reviews to get a balanced view.

Alternatives to Beagle – The choice is yours!

Blooom:

Blooom is a similar service that specializes in optimizing employer-sponsored retirement accounts like 401(k)s. They offer personalized advice and management to help you make the most of your retirement savings.

Also read: Doxfore5 Python Code – Know About Doxfore5 In Detail!

Personal Capital:

Personal Capital provides a comprehensive financial management platform that includes retirement planning tools. They offer free retirement account analysis and investment advice tailored to your goals.

Wealthfront:

Wealthfront is an automated investment service that offers retirement planning along with other financial services. They use advanced algorithms to manage your investments and help you reach your retirement goals.

Betterment:

Betterment is an online investment platform that offers retirement accounts along with other investment options. They provide personalized advice and automated portfolio management to help you grow your savings over time.

These alternatives offer different features and pricing structures, so it’s essential to compare them to find the best fit for your financial goals and preferences.

Frequently Asked Questions:

1. What does Beagle do?

Beagle helps you find old 401(k) accounts, reduce hidden fees, and consolidate your accounts into a new one.

2. How much does Beagle cost?

Beagle charges a one-time fee ranging from $19 to $45, depending on the plan you choose. This fee covers the cost of account recovery, management, and other services provided by Beagle.

3. Does Beagle offer a free trial?

No, Beagle does not offer a free trial. They charge a one-time fee ranging from $19 to $45, depending on the plan you choose. However, they provide a money-back guarantee if you’re not satisfied with their service.

Summary:

So, is Beagle legit? Yes, Beagle is a legitimate service that helps you find and manage your old 401(k) accounts. It can help reduce hidden fees and simplify the management of your retirement savings.

While there are some fees involved, the benefits of using Beagle can outweigh these costs, especially if you have multiple old 401(k) accounts that need attention.

Read more: